Macro Ark

Compound Interest 101: Turning Pennies into Fortunes

May 21, 2025

I’ve heard that Albert Einstein called compound interest “the 8th wonder of he world”. Now why would he say such a thing like that? Many people don’t understand how interest works — likely since they don’t really understand what it is or perhaps don’t understand it’s power. If you want to know more, read on…..

In this post I want to give a brief overview of what compound interest is and why you should not only understand it but harness its power to leverage your finances and help shape a better financial future for yourself. Investopedia defines compound interest as:

“Compound interest includes interest on the initial principal balance of a loan or deposit and accumulated interest from previous periods.”

Think of a snow ball rolling down hill getting bigger with every revolution as the new snow builds on the existing snowball. Taking this one step back, just to be clear, Investopedia defines interest or “simple interest“ as “an interest charge that borrowers pay lenders for a loan.” Simple interest is calculated using the principal only and does not include compounding interest.

Simple interest relates not just to certain loans. It’s also the type of interest that banks pay customers on their savings accounts.”

How Compound Interest Works:

The formula: A = P(1 + r/n)ⁿᵗ

Key Variables:

Principal (P): amount of money deposited.

Interest rate (r): rate at which the bank applies to the account. Convert this to a decimal.

Number of compounding periods (n): how many times per a given time period the interest is compounded. In this case let’s use n = 12 which means monthly for 12 months over a year.

Time (t): this would typically be in years.

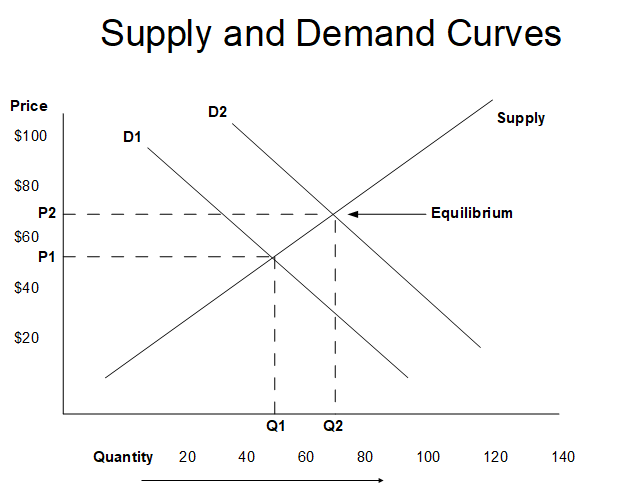

So what’s the secret sauce of compound interest you might ask? As shown in the graph above, that magic ingredient is time. As the old saying goes “Time in the market beats timing the market”. For example if you are saving for retirement and start investing at 25, it is much more advantageous than starting at 35 and saving a little more money.

For example, in order to reach $1,000,000 by age 65 if you start investing at age 25 you will need to save approximately $286 per month (depending on the interest rate). If you start saving at age 35 however, you will need to save approximately $670 per month which is over twice as much needed per month as shown in the graph below.

Another key ingredient to this topic is the interest rate your bank is giving. In recent years, with inflation going up, bank increased the interest rates of loans. This had the positive effect of increasing the interest rates on savings accounts compared to the essentially non-existent interest rates prior to the recent run up in inflation. But interest on something like US Treasury bonds now actually lends to adding to a growing account of money. So what’s the easiest way to begin savings and harness the power of compound interest?

If you are disciplined, you can just ensure that you invest some money on a regular basis, which is typically monthly. For most people, automatic investments are the easiest way to invest. With automatic withdrawal you can leave it to your bank or employer to make the withdrawal for you and deposit it into the investment account. This can be done in a variety of ways such as with a company offered 401(k) or withdrawals from your savings or checking account into an investment vehicle.

The key to remember here is that time is your best friend if you start early. But even if you don’t start early (which is relative anyway) you should never feel that it is too late to invest.

As the saying goes: The best time to plant a tree was 20 years ago. The next best time is today.”

So it goes with savings/investing. So start now and let the power of compound interest work for you. You’ll be amazed at the results.

And now you know. Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial advisor and am in no way qualified to offer investment advice. This article is for information and entertainment purposes only.

Tariffs: Protection or Punishment?

May 17, 2025

So here we are towards the end of May and I think we all know by now what the word of the year will be. Well by the blog title you’ve probably guessed “tariffs”. I might be going out on a limb with that proclamation but unless you’ve been living under a rock since the election of President Trump, it’s been kind of hard to not hear or read about tariffs on a daily basis.

In this blog post, I want to talk a little about what tariffs are, the history of tariffs in the US, what’s happening with tariffs now in the US and what it means to all of us in both the US and the rest of the world.

According to [Britannica.com](http://Britannica.com) a tariff is “a tax levied upon goods as they cross national boundaries, usually by the government of the importing country. The words tariff, duty, and customs can be used interchangeably.”

Going a little deeper into the definition, there are 4 types of tariffs:

Ad Valorem Tariff: A tariff calculated as a percentage of the value of the imported good. This is a percentage based tariff. If an imported good costs $100 and the Ad Valorem Tariff is 10% then the dollar value of the tariff is $10.

Specific Tariff: A fixed fee charged per unit of the imported good, regardless of its value. For example, $5 imposed on every ton of imported rice.

Compound Tariff: A combination of an ad valorem tariff and a specific tariff. For example, the $10 of the ad valorem tariff plus the $5 for the specific tariff

Tariff-Rate Quota (TRQ): A lower tariff is applied to imports within a set quantity (quota), and a higher tariff is imposed on quantities above that. For example, the first 10 tons of a good are taxed at 10% and anything over 10 tons is taxed at 25%.

One of the things that surprises me most about all of the current tariff talk is that most people seem to not understand that they have been around for a very long time. One might be surprised to know that tariffs go back far in history. Ancient civilizations such as Egypt, Rome and people in Mesopotamia city states were charged taxes to send goods across city state borders.

As far as tariffs go in the US, in 1789, Congress passed the first major law of the US with the Tariff Act of 1789. This was then signed by President George Washington and was designed to protect manufacturing of the fledgling United States and to raise revenue for the federal deficit. Early tariffs in the US were one of the federal government’s main sources of income. As a matter of fact, before income taxes were imposed, tariffs made up 90% of government revenue.

During the 1800’s the use of tariffs increased in the US as a way to continue protecting manufacturing and raise income. Northern states were generally in favor of tariffs as they protected industry.

Southern states however exported a great deal of products, including cotton, to Europe and as you might expect, this led to retaliatory tariffs imposed on US goods by European nations. This tariff tension between the northern and southern states almost led to civil war in the early 1800’s. After the Civil War, the US government still pushed for higher tariffs so as to help the industrial expansion of the US. By the early 1900’s, the US had imposed income taxes on the US populace which reduced the need for tariffs.

Now enter the 1930’s, and with that the Smith-Hawley Tariff Act which was signed into law by President Herbert Hoover. Some might say this Act was an example of tariffs gone wrong. Tariffs were raised to record levels on over 20,000 good which resulted in immediate retaliation which some say worsened the Great Depression. When World War II started, the US and the rest of the world was lifted out of the depression since wars tend to be good for economies.

By the end end of 1945 the war was over and it was time for the politicians to plan for the future. With memories of the depression top of mind, politicians in the US lead the movement for lower tariffs with the passage of the General Agreement on Tariffs and Trade (GATT) which was passed in1947. GATT was essentially a multi country trade treaty designed to promote international trade by reducing or even eliminating trade barriers such as tariffs.

By 1995 GATT had eventually morphed into the World Trade Organization or WTO. The WTO’s job is to facilitate international trade in goods and services which like its predecessor, GATT, wanted to eliminated trade barriers.

Okay, so now we know what tariffs are and some of the history of tariffs in the US but are they actually good for a country? Unfortunately, in the US the topic has become polarized and for the most part one’s support or objection to tariffs is somewhat based on political affiliation.

As with most things, when subjective biases come into the equation, rational decision making often goes out the window. That’s okay for people on the sidelines who aren’t part of the decision calculus but for those who are actually part of the process, do they really know both the pros and cons of tariffs and if so are the pros and cons weighed objectively or just spun to promote one’s political agenda?

That said, let’s get into the pros and cons of tariffs. Following are some of the pros to why a country would want tariffs:

Protect domestic industries: As I’ve written about in the past, the true source of a nations wealth is it’s manufacturing prowess. The main idea of tariffs is to strengthen a nations manufacturing base to keep it strong and provide jobs for its citizens.

Source of Government Revenue: As mentioned earlier in this post, tariffs can be a significant source of government revenue, especially for developing nations that don’t have a large tax or manufacturing base.

National Security: National security definitely gets a boost from tariffs related to the production of critical goods such as semi conductors, pharmaceuticals or any goods related to a nation’s defense or technology industries.

Trade Leverage: Tariffs are a form of leverage against other nations to negotiate favorable trade deals.

Now let’s look at the cons of tariffs.

Higher Prices: Higher prices is the most obvious of the cons and the one we now hear the most about in the US. Critics claim tariffs are a tax on consumers who are already cash strapped after the last five year of higher inflation and interest rates.

Retaliation / Trade Wars: Countries who have been hit by tariffs can impose their own tariffs making the cost of exports more expensive. This could lead to reduced exports and therefore a decrease in manufacturing in the exporting nation. Over time, this could lead to instability in global trade.

Manufacturing Inefficiencies: If companies know they are being protected through the use of tariffs, this can lead to complacency regarding innovation, quality and overall competitiveness. Think the US auto industry in the 1970’s and 80’s. This could then lead to economic stagnation.

Supply Chain Disruptions: Tariffs on components can lead to re-sourcing of suppliers due to the higher costs. This creates instability in supply chains.

The Law of Unintended Consequences: An increase in employment in one industries could lead to a decrease in employment in others. When uncertainty in employment and prices are taken into account, consumers spending is often cut back as it investment and hiring by companies. This can become a bit of a self fulfilling prophesy leading to recession.

The US is now deeply engaged in tariffs with many countries around the world and the situation seems to change daily to the point that I’m not sure anyone outside of the government can actually tell you want tariffs are in play against what countries on any given day. President Trump did call for a 90 day pause on tariffs on all countries but China. No surprise there as he sees China as the biggest economic threat to the US.

And if you have been paying attention to this topic, China has in fact responded in kind with tariffs on US exports as has Canada. Some countries are coming to the bargaining table and striking deals with President Trump. Others are likely taking a wait and see approach.

There is talk in Detroit of car prices going up but at the same time, I’ve heard that automotive parts will be exempt from tariffs. There is also discussion of both foreign and domestic companies investing in the US to avoid tariffs. The concern is that the US economy is on somewhat shaky ground and aggressive tariffs can have negative impacts on the economy as discussed above.

Although the last few years have seen a relative decrease in inflation, interest rates still remain high. The price of gold is soaring and the stock market is down about 8% for the year. It might not take much to knock the first economic domino over and start a cascade of economic turmoil.

So what does all this really mean for the US as well as the rest of the world? As I like to say in many of my posts, time will tell. I think the 90 day pause is a good thing in that it gives countries time to re-negotiate trade deals with the US and at the same time gives US domestic industries time to digest what this all means and plan on how to respond.

With that I’ll end this post here but will likely have more articles on tariffs as 2025 plays out. And now you know.

Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualifed to offer financial advice. This article is for information and entertainment purposes only.

Can BRICS Challenge the West’s Dominance?

April 8, 2025

The BRICS continue to make waves globally but most people probably still aren’t aware of what they are or the challenge they pose to the West’s dominance of the global order. Is this challenge real and if so what are the implications for trade, geopolitics and the future?

First of all, what are the BRICS? BRICS stand for Brazil, Russia, India, China and South Africa. Initially BRICS did not include South Africa but it was later added. As a matter of fact, as of January 2024, BRICS added Saudi Arabia, United Arab Emirates, Egypt, Iran, Ethiopia.

Now as of January 2025, 9 additional countries were added. Those nine countries are Cuba, Belarus, Bolivia, Indonesia, Kazakhstan, Malaysia, Thailand, Uganda and Uzbekistan. So now BRICS is comprised of 19 nations, which makes up 50% of the world’s population and 41% of the global economy.

Initially, the original BRIC nations were simply thought of as nations where Western countries could invest and help develop economically so as to essentially create strong trading partners. The acronym was made to identify the four original countries and the business world was buzzing with how the BRIC nations would boom economically.

Companies invested in the four nations hoping for economic miracles. Clearly this was the case with China. China however is a bit of a different case since it’s economic rise was already in motion long before the idea of the original 4 BRIC nations.Brazil has been somewhat of an anomaly in that must of their policies toward trade and investment were somewhat prohibitive with trade barriers with relatively high import tariffs and other governments regulations that can be very complex. Technical regulations can also serve as barriers to trade.

India has somewhat had some trade obstacles such as tariffs and its regulatory environment. However the sheer size of it’s population can’t be ignored as an economic powerhouse.That said, India faces geopolitical tensions with its cross border rival China. Border tensions continue to strain Indo-China relations as does China’s Belt and Road Initiative which India has opposed due to issues of sovereignty. India also seeks a balanced foreign policy by strengthening ties with the West while at the same time engaging the other BRICS which is often at odds with the West.

Now what about gold and how does that come into play with BRICS? As I write this the price of gold is slightly over $3,000 USD per ounce. This is being driven in large part by central banks around the world stockpiling gold. This includes of course, Russia and China. Continued uncertainty in the stock market is also adding to the upward price pressure of gold as people are looking for safer alternatives to what is shaping up to be a somewhat turbulent year.

So why are central banks stockpiling gold? Do they know something that the rest of us don’t? Or do they simply understand the value of gold and might be looking to go back to various gold backed currencies? Or are the BRICS nations thinking of something along the lines of starting their own currency to challenge the US Dollar as the major world reserve currency.

So how does oil come into play with BRICS? With Russia and Brazil being among the world’s largest oil producing nations and with China and India being among the world’s largest consumers of oil, there is a natural fit for strengthening trade in oil.With that, the question becomes what would the oil be traded in? Petrodollars? Likely not. If I had to guess I’d say they would traded in Petroyuan. Now some oil is already traded in Petroyuan so continuing down that road is an obvious choice. The concern with this for the US is that for every Petroyuan in circulation, there is need for 1 less Petrodollar.

Over time, if the Petroyuan gets traction globally, each Petrodollar not in use becomes homeless and the concern is that it would find its way back to the US with inflationary effects.This would also be a direct challenge to the US dollar as the primary reserve currency of the world. In general, this would strengthen the BRICS position on the world oil market and weaken that of the US/West.

As far as military strength goes, once again China and Russia take the lead. Both have nuclear weapons and substantial militaries with increasingly lethal navies. In recent years they have conducted joint military operations and both continue to modernize their militaries while also engaging in hybrid warfare which includes propaganda, economic warfare and cyber warfare. All of these pose a direct threat to the West.

Although not a military bloc, BRICS other members have also engaged in military operations. This almost certainly will lead to increased trade in military weapons and assistance with regional security issues.

So with increased trade, military and economic cooperation it sure seems like BRICS is setting itself up for a direct challenge to the West. Or at the very least to be able to be less dependent on Western military, economic and financial hegemony.

Keep in mind however the BRICS are a diverse group of nations, each having its own degree of autonomy from or reliance on Western influence. The question is will they act more or less autonomously or coalesce into an economic and military powerhouse that will shake up the existing world order? Time will tell. I’m not sure about you but I am very curious how this story unfolds.

And now you know. Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualified to offer financial advice. This article is for information and entertainment purposes only.

Don’t Be Left Behind: Why Economic Literacy is Crucial in Today’s World

February 19, 2025

Well here we are in February and the year has started off with some question marks. What will this year bring and do you understand its economic impacts?

Yes, we have a new president but some people argue that a president really doesn’t have much control over a country’s economy. Some are convinced a president can easily sway an economy and many in the US are waiting for Trump to magically make everything better (if you voted for him to bring down prices and interest rates). I fall somewhere in between. In a truly free market economy, the president shouldn’t have any direct say over an economy but certainly can help influence it.

Regardless, 2025 should prove to be an interesting year and I still can’t decide how I think the year will go. The much awaited stock market meltdown that I think should have happened years ago still has not transpired. Not that I want it to but since the financial crises of 2008 I am still not seeing how a handful of companies can keep it going for 17 years.

I know it has had some help via government intervention but still, I just can’t do the math on that one. Sometimes when I turn off my rational brain I think the gravy train might just keep going. What if some of the new economic policies being put into place are enough to keep the economy moving along or even strengthen it? I think the answer is likely in between. A sideways market that will leave passive investors frustrated but be full of opportunities for active investors who pay attention to basis economic principles. This brings me to the reason for this post and ultimately, for the purpose of starting Macro Ark — wanting to impart some knowledge about economics on people who aren’t inclined to seek such knowledge.

Economics for the average person is dry, boring, confusing and thus can be frustrating. But like most things in life that are good for you, a commitment is required to get better at it. You can’t get in shape without eating right and working out.

It’s extremely hard to succeed in just about anything without giving it some effort. The same goes for your financial well being. You can be financially prudent but if you don’t understand the market dynamics that can impact your finances then you run the risk of missing out on investment opportunities or worse, taking financial hits. In short, understanding economics will help you navigate the complexities of today’s world.

Things all around us are changing daily. From AI to cryptocurrencies to the job market, to geo political events. The new administration in the US appears to be taking a blow torch to many of the government agencies and policies that have been around for years if not decades. No one can say for sure what impact this will have on the US and therefore global economy.

As we all know things have been kind of crazy over the last five year. Wars, interest rate hikes and reductions, inflation spikes and drops, supply chain constraints, a container ship stuck in the Suez Canal…….You get the picture. The world changes daily. So how do you protect yourself from the wild gyrations of the global macro environment? You arm yourself with knowledge.

Ask yourself some questions first:

1. Do I understand what the current inflation rate is?

2. Do I know what the Fed funds rate is? Both by definition and the actual value? And knowing this, how the fed funds rate impacts the interest rate of purchases I make on credit

3. Do I understand what a recession is and what are some of the market forces that cause it?

4. Do I really know what causes inflation?

5. Do I know what the money supply is?

6. Do I understand the history of gold as it relates to national currencies?

7. Do I know what a country’s central bank is and how it works?

8. Do I realize that central banks around the world are buying up gold in large quantities and appear to be just stockpiling it?

9. Do I know what the BRICS nations are and what the implications are for the current global financial system?

10. Do I understand what compound interest is and how the long term effects can have life changing benefits to my life?

I would take an honest assessment of these questions and if you feel you aren’t quite proficient in the knowledge necessary, just keep learning. Every day make it a point to read or listen to a podcast for 30 minutes about finance, banking, economics, precious metals, cryptocurrencies etc. You’ll be surprised how much you learn in a few short weeks. Now let’s look at some global events that are taking place in real time. President Trump is threatening to put tariffs on goods imported from Mexico, Canada, China and possibly from Europe. So how does this impact the consumer? The short answer is that prices will go up since the cost of the tariff (i.e. import tax) will simply be put onto the goods being imported and ultimately passed to the end consumer.

So what’s the point of tariffs? The idea is to make the imports expensive enough to cause companies from the home country to make those products domestically, thereby creating jobs which benefit the nation’s citizens. The tariff discussion in the US seems to be getting a lot of attention now (mostly negative).

What many fail to realize is that the US has imposed tariffs throughout history but perhaps with much less fanfare. For instance Trump did impose tariffs on certain goods from China during his first term with some of them still being in effect.

Before becoming president of the US, then Congressman McKinley proposed tariffs via the Tariff Act of 1890 which increased tariffs on all imported goods on average to 49.5% (from 38%). Some tariffs however were lowered. My point is that tariffs are not new and over time tend to level out the prices of goods. So a little bit of a sidetrack there but I did want to talk a little about tariffs.

Regarding inflation, on February 12th, it was announced that it is increasing again. Inflation increased .5% since December, bringing annual inflation to a rate of 3%. Will it increase further? If so, will the Federal Reserve raise rates again? If so, what does that mean for home and car loans, credit card interest rates? Will it tank the stock market? All things that must be considered when trying to understand where to invest, when and if you should buy a home or car etc.

The point of this article is to get you to think about what you should know about economics vs what you really do know. When making decisions, the more information and understanding you have of economics, the easier it will be to put together short, medium and long term plans for your life. Always remember that economics touches every aspect of our lives whether we like it or not so why not see life through the lens of clarity and understanding rather than that of confusion and angst?

And now you know more about the importance of economics. Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualified to offer financial advice. This article is for information and entertainment purposes only.

The Silver Bullet: Is Now The Time To Invest In Silver?

February 18, 2025

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

For the last 5,000 years, silver has been used for both jewelry and for money and eventually it found its way into technological uses. Civilizations have had a weird relationship with silver over the centuries. Let’s take more of a look at its history and what its future might be especially as an inflation hedge and a way to diversify your investments.

Going back the the ancient world, both Greece and Rome used silver as a prominent form of money. At one point, the Greek tetradrachm was used throughout the Mediterranean. Gradually, as banking systems started to rise in Europe, Florence created the silver “florin” which played a keyed role in the early European financial systems.

When the Spanish found their way to North and South America, they found and mined silver throughout the 16th and 17th centuries. The silver (and to be fair, also gold) played a crucial role in the Spanish colonies and led to Spanish dominance in Europe and provided the funding for additional global exploration and commerce.

In early colonial times the American Colonies used silver to a certain degree largely due to the significant influence of Spanish silver. Eventually, after gaining independence, the early US went to what is called a bimetallic system whereby both silver and gold were used to back early American currency. The first silver coins were minted in 1794 by the fairly new US Mint. Banks at the time held silver reserves and many day to day commercial transactions used silver coins.

Eventually however, gold won out over silver as the standard for US banking and for many countries throughout the world. With the discovery of new silver mines the supply of silver was abundant, which devalued silver relative to gold which was much more rare. Countries eventually switched to gold as the standard banking system since gold was easier for the promotion of international trade, offered better price stability and stronger national currencies.

With the industrial revolution however, silver’s value rose again due to its many industrial uses. Initial uses of silver in industry include photography and very early electrical components. As time wore on its usage increased. Soon it was used in dentistry for crowns and fillings but due to its conductivity it was increasingly adopted for electronic applications. Nowadays, for example, we now see silver usage increasing with the additional demand in the automotive sector due to the slow but steady increase in demand for electric vehicles.

As the most conductive of all metals, silver is used in many applications where electrical conductivity is crucial. Examples include switches, relays, connectors, high power cables and various other electronics in a vehicle. Silver is also used in solar panels which, although not used in electric vehicles, is a key component of the green movement.

If demand for EV does take off like some experts project, demand for silver will sky rocket and with that so will the price. Hyperbolic predictions from podcast guests call for upwards of $100 per ounce although I think that is overly optimistic especially with the new president and not knowing what that means for the near term volumes of electric vehicles. The price per ounce of silver as of this writing is $31.57 but I could see silver getting into the $50 range over the next few years and with that said, Robert Kiyosaki recently predicted silver to hit $70.

As with gold, you don’t buy silver to get rich. You buy it as an inflation hedge. As the cost of goods increases with inflation, thereby devaluing the purchasing power of the US Dollar, the value of silver will increase due to its intrinsic value and industrial demand. Silver tends to hold its value during times of high inflation however there is price volatility so there never is a guarantee.

One might argue that it also has a limited supply but that would only be the case for newly minted coins, bars etc as the supply of silver yet unmined is thought to be significant. Although silver can be mined separately, its production is often a by product of mining for other metals such as copper and zinc. The silver supply then is somewhat tied to the demand for these other metals.

Following are some of the forms that physical silver can be bought:

Coins — Probably what most people think of when they think of silver as an investment. Coins are minted by government mints and are legal tender (i.e. money). They can be bought in whole one ounce coins which are called a troy ounce. Or they can be purchased in fractions of an ounce.

Bars — Bars are rectangular bars and come in sizes ranging from 1 gram to hundreds of ounces. The lower premium over spot (market price of a metal) make it attractive for some investors who want to buy large quantities.

Ingots — Similar to silver bars in how they look, ingots are slightly less refined than silver bars which have more intentional designs. Ingots are oftentimes re-melted to be made into silver bars.

Rounds — Rounds are produced by private mints and have no face value and therefore are not considered currency. They will typically have specific designs and are oftentimes used as collectibles.

Junk Silver — Junk silver is another term for US coins minted before 1965 and contain 90% silver. These coins are no longer in circulation so they appreciate due to scarcity as well as due to the value of the silver. Junk silver also can be bought at a lower premium so is attractive to investors as a more affordable way to buy silver.

Jewelry — Jewelry is an easy way to invest in silver and doesn’t require any explanation.

To buy coins, rounds, ingots or bars you can easily find dealers online who will mail the silver to your house. Owning physical silver has both pros and cons. The pros include having it readily available especially if you keep it in your home.

Coins, as mentioned above can be used for currency in an emergency and all forms of physical silver can be used for barter if necessary. The downside is that if you keep physical silver at home, you are at risk of losing it to fire or theft. You can however store you silver in a third party lock box which helps for security purposes but obviously makes it less accessible.

An indirect way to own silver is to buy shares of mining companies. In that case, you essentially own paper silver. Mining companies are just want they sound like — companies whose purpose is to mine the ground for specific metals. Owning shares in the a mining company is just like owning any other company stock.

You can also own stock in a mining royalty company. Owning stock in a mining royalty company is relatively lower risk way to own silver on paper. Royalty companies do not actually mine the silver but get paid royalties by the companies that do which can lead to stable revenue streams.

A final way to own silver not in physical form is through an Exchange Traded Fund (ETF). The ETF actually holds the physical silver and the shares of the ETF you buy represent your ownership of the physical silver. ETF’s are traded like stocks and the prices fluctuate with the price of silver. Buying ETF’s is an easy way to invest in silver and is more cost effective than buying physical silver due to the lower premiums.

When thinking about owning silver, keep in mind that silver is no different than any other investment and is subject to market volatility. The volatility doesn’t compare to that of a cryptocurrency but can’t be dismissed either. Owning silver whether in physical form or via stocks is a great way to diversify your portfolio. But as with any investment do you research prior to buying silver in whatever form as you do stand to possibly lose your investment given the uncertainties of the market.

And now you know a little about silver. Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualified to offer financial advice. This article is for information and entertainment purposes only.

Web 3

February 18, 2025

So here we are at the start of a new year. And as a reminder, the 2020’s are now officially half over. I’m not sure why but doing the math on that made me feel a little uneasy.

Maybe it’s just because time seems to be going so fast. Or maybe it might have something to do with the increasingly rapid pace of change of technology. With each passing month it seems I’m learning more and more about new technologies and as interesting as it can be I am always wondering where this will all lead us.

The internet was disruptive. It flipped society on its head. That said I wanted to write a little about Web 3. You’ve likely heard the term before but before I go into Web 3, first I’ll define Web 1 and Web 2. Technopedia defines Web 1 as “The earliest version of the internet characterized by static web pages that users could only read, without any interactive features or user generated content.” Seems like a pretty straightforward definition.

To be honest, I’m not even sure I remember Web 1. Likely this was due to the fact that I didn’t start using the internet until the late 90’s. Okay, so what is Web 2? Web 2 defined by Investopedia as “Web 2.0 is a term used to refer to the second stage of the Internet, which has more user-generated content, greater usability for end-users, a more participatory culture, and more inoperability compared to its earlier (first) incarnation, Web 1.0, which was dominated by static websites.”

So Web 2 is the iterative step from Web 1 that includes actual user interface. Web 2 was a quantum leap for the internet and quickly found its way into the daily lives of people around the world. Suddenly, with the help of search engines, you could look up any topic you could imagine and within seconds have a world of information in front of you.

Then suddenly, day to day activities such as shopping went on line and society never looked back. The world was then forever online. Business’s flocked to the internet. Search engines opened up information to anyone about anything. We were forever changed.Fast forward a few decades and now here we are with Web 3. Although only in it’s infancy, it stands to be the next great revolution for mankind. I know that sounds like a grandiose statement but let’s take a look at what Web 3 is and how it will impact our lives. Think Web 2 disruption times 1,000.

At the heart of Web 3 is decentralization. Web 3 seeks to shift power more to individual users and away from companies such as Google, Facebook etc. The central tenant is that users control their own data, assets and therefore their own online experience.

One of the key components of this is blockchain technology which can operate without any central authority in control. Note that blockchain is still relatively new and still faces many challenges but the foundation has been laid. For example, a blockchain technology such at Bitcoin (capital B) enables users to control their money through bitcoin (small b) the cryptocurrency away from any traditional financial institutions.

As with the dot.com era, time will tell what blockchain projects rise to the top and become the dominant players. We are now in the early innings and the world of Web 3 is more like the wild west.

Potential use cases for blockchain include using it for contracts, personal data and supply chain management.

Regarding contracts, these are referred to as “smart contracts” which reduce the need for third parties and are immutable. Think of world where things such as licenses, titles to your house and car and personal financial and medical information exist on line on the blockchain. This does cause one to wonder how secure your data is but that is one of the main points of blockchain technology. Being immutable, it is unable to be changed. With the decentralized aspects of blockchain, your data is secure with access by only the individual.

For supply chain management, blockchain is optimized to tracking the movement of goods, increasing transparency and reducing fraud. Companies and individuals can trace orders more easily. Inventory management suddenly becomes easy. Inventory losses will plummet since every movement of parts is recorded in real time on the blockchain. This certainly will add to corporate profitability and less frustrated customers.

Another aspect of Web 3 is the metaverse. You’ve likely heard a lot about the metaverse over the last few years but what really is it? It must be somewhat relevant if Facebook changed it’s name to Meta and is looking to become a big player in that space. Wikipedia defines the metaverse as “The metaverse is a loosely defined term referring to virtual worlds in which users represented by avatars interact, usually in 3D and focused on social and economic connection.”

We can see this now in the rise of blockchain associated gaming. Some crypto projects allow for buying property in a virtual world where location drives prices as it does in the real world. As strange as this seems I can see where things like this might be forms of investment. If you can’t own property in reality, own it in the meta verse.

This presumably would continue the expansion of online communities where people might feel a sense of belonging, particularly if they feel marginalized in reality. Along with the communal aspects of the metaverse it is clear to see increased entertainment and the associated commercial opportunities. As with any new technologies, Web 3 / blockchain will help foster innovation and creativity. This will undoubtedly spawn ever new technologies, potentially paving the way for the inevitable Web 4.

Companies will come and go as they compete for market share. Throw in a dose of AI and I kind of feel all of the new technologies a little unsettling. Not so much for what they bring to the table as mentioned above but for what those technologies and use cases might lead too. Good or bad, it will certainly be interesting!

As I’ve stated before, my mission is to inform as many people as possible about various topics so as to be in a better position to prepare for their futures. Knowing a little about Web 3 just might help someone make some good decisions for their future.

I for one will continue to learn as much as possible about Web 3 so to continue exploiting new investment opportunities when they arise.

And now you know. Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualified to offer financial advice. This article is for information and entertainment purposes only.

The 5 Economic Concepts You Didn’t Know You Needed to Know

January 15, 2025

As noted in my About page, my purpose of starting Macro Ark is to help people who aren’t naturally inclined to like or know about macroeconomics better understand some basic ideas and concepts so that they can make informed decisions in their day to day lives and prepare themselves for a better future

Over the last year or so I’ve written about a variety of topics. Some are current event related macro economic topics, some related to cryptocurrencies and earlier on I wrote a lot about some of the basic principles of economics.

Now as we start 2025, and I look around the macroeconomic landscape, I see a need more than ever for people to really understand some things. Below are 5 topics that I think everyone really needs to know about at least at a high level. I’ve written about each of them in the past and intend write a more about other important principles.

Supply and Demand — “Supply and Demand” — October 4, 2023

Fiat Currency — “Fiat Currency” — October 16, 2023

Fractional Reserve Banking — “Fractional Reserve Banking” — December 5, 2023

The Gold Standard — “Gold vs Bitcoin” — February 1, 2024

Inflation — “Inflation — The Hidden Tax” — January 4, 2024

I know these topics can seem dry, boring, confusing and flat out un-interesting to the majority of people but for guys like me I find them fascinating which is why I am so passionate about macroeconomics. When I write I try to present topics in such as way as to keep people who don’t share my same passion for macroeconomics engaged to the point that they feel that they learned something and it wasn’t complete torture during the process. Part of the reason I keep my posts somewhat short is so that I don’t lose readers.

The point after all is to keep a reader engaged to the point that they have learned something. Going forward, I will continue to write both about specific economic topics (think textbook) as well as current news about macroeconomics, crypto currencies, precious metals and world events that impact the global macroeconomic system. I look forward to posting future articles. If there is something specific you want me to write about just let me know.

Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualified to offer financial advice. This post is for educational and information purposes only.

The 2024 Economy: Ups, Downs, and What’s Next

December 29, 2024

So here we are in the last days of 2024 and by now you’ve probably started to look back on 2024 and take stock in the macro economic environment and likely any investments you might have. So how does 2024 look in the rear view mirror? Let’s take a look.

I guess if I had to pick one over arching topic for 2024, I’d have to say inflation and the resulting interest rate cuts. For the first 11 months of 2024, the inflation rate averaged 2.9% with the November inflation rate coming in at 2.7%, inching up slightly from the September low of 2.4%.

With inflation rate trending down since January the much anticipated interest rate cut happened in August when Fed chairman Powell cut the Fed Funds Rate 50 basis points. The Fed then cut rates a second time in November and somewhat unexpectedly a third time in December.

You can make the case that another huge year for the stock market was a bigger headline. but at this point, the rate cuts are signaling what we all what to hear — that inflation is under control and it’s time to get more bullish about the economy. But is this really the case?

Cryptocurrencies have had a huge year, led by the Bitcoin ETF launch in January and then the Bitcoin halving in April. Now the price of Bitcoin is hovering around $93,500 which is a huge story in itself. But as big as the meteoric rise in Bitcoin was this year, it didn’t really impact that many people. The number of people who own Bitcoin in only about 30% so the relative impact isn’t as profound as that of the interest rate cuts.

Yes, the stock market did have another great year with the S&P 500 on track to gain over 26%, but after two years of huge gains it almost seems that most Americans just expect returns north of 20%. The unemployment rate edged up a bit in November to 4.2% which might seem like a lot but keep in mind that an unemployment rate of 4% is considered to be “full employment”, meaning anyone who is looking for a job can get one.

That said, it’s hard not to notice the endless stream of layoffs being announced in industry after industry. And as we all know, the psychological effects of getting laid off or of just the threat of being laid off can add to an economic slow down as people start to rein in spending. This can then lead to businesses reducing output and thereby creating a need for more layoffs.

With that the economy does still seem to be doing okay. I spend a lot of time reading and listening to podcasts on the macro economic environment and it seems that there is no shortage of economists who feel that the next few years will be boom years. With the new administration coming in January, there is much optimism about some of the proposed policies that will be put in place (and I must say also some trepidation for the possible tariffs).

The wars in Ukraine and the Middle East certainly were worrisome but did not seem to impact the economy too much in North America. That said, Germany is now on the brink of a recession with growth at .2% in the third quarter. If it does slip into recession it quite possibly might drag the rest of Europe into recession as well.

The US Economy is expected to expand in 2025 although not as much as in 2024 with growth expected at 2.4%. But what about inflation? I hear more and more talk about higher inflation in 2025. Now anything higher than what we had in 2024 could possibly upset the applecart since many Americans are already stretched to the limit of their finances.

Always remember that inflation is cumulative, meaning that this year’s 2.4% was on top of last year’s 4.1% which was on top of 2022’s rate of 8.0% and so on. It seems that most people don’t really understand this until they get to the checkout line and wonder why everything costs so much since inflation is “coming down”. Well it’s the inflation rate that is coming down, not the cost of goods and services (in the aggregate).

So for 2025, the groundwork for a strong(ish) economy is there but there are some possible storms on the horizon. If things get out of hand in either Ukraine or the Middle East, or even in Asia, then all bets are off for continued growth. With the stock market near all time highs, it won’t take much to pop the bubble. If that happens, watch out below.

Happy New Year and thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualified to offer financial advice. This post is for information and entertainment purposes only.

DePIN: Where Blockchain Meets the Physical World

December 13, 2024

If you follow blockchain related topics, you’ve probably heard the term “DePIN”. So what does DePIN stand for? DePIN stands for “decentralized physical infrastructure network”. Okay, now that I’ve defined the acronym, what is it really?

DePIN is a concept where decentralized systems incentivize the deployment and operation of real-world physical infrastructure, blending blockchain technology with physical assets or networks. DePIN is part of the Web3 ecosystem and often intersects with concepts like tokenization and decentralized autonomous organizations (DAOs).

Think of it as the “internet of things” for blockchain and blockchain applications. DePIN projects rely on participants to contribute physical assets, such as hardware, devices, or other infrastructure, to support a network. These contributors are typically rewarded with tokens or other incentives tied to the blockchain. Examples include networks for telecommunications, transportation, energy, and environmental monitoring. Let’s take a look a little further into some use cases and potential benefits / drawbacks.

Key Examples of DePIN Projects

Helium Network: Uses blockchain to incentivize individuals to deploy wireless hotspots for IoT and 5G networks.

Filecoin and Arweave: Incentivize individuals to contribute storage resources for decentralized file storage systems.

HiveMapper: A decentralized alternative to mapping services like Google Maps, relying on contributors using dashcams to build maps.

Potential Impacts on Blockchain and Society:

Wider Adoption of Blockchain Technology: DePIN enables blockchain to step into real-world use cases beyond financial applications, demonstrating its utility in tangible infrastructure systems. This further underscores what I’ve mentioned several times before. The blockchain genie is out of the bottle and DePIN is serving as an accelerant.

Decentralized Ownership Models: By rewarding contributors, DePIN creates a participatory ownership model where users are also stakeholders, fostering broader economic inclusion. Somewhat like I mentioned above, when users can become stakeholders and are rewarded as such, broader adoption will ensue.

Cost Reduction for Infrastructure Development: Traditional infrastructure projects are capital-intensive and centralized. DePIN shifts these costs to individuals or smaller contributors, lowering entry barriers.

Resilience and Accessibility: Decentralized models improve network resilience by reducing reliance on single points of failure, making essential services more accessible.

Tokenization of Real-World Assets: DePIN accelerates the trend of tokenizing physical assets, which can make infrastructure investment more liquid and accessible to smaller investors.

Challenges and Risks:

Regulation: Governments might view DePIN models as unregulated public utilities or securities. In the US however, at least in the near term with Trump about to take office again in January 2025, it appears that excessive government regulation in the US will likely be minimized.

Adoption Hurdles: Large-scale adoption requires significant education and buy-in from users. The biggest incentive to adoption is monetary. As the prices of tokens and coins go up, people will self educate about blockchain so as to be in a position to capitalize on it.

Network Quality Assurance: Ensuring consistent service quality across decentralized participants can be challenging.

Summary

DePIN holds the promise of transforming the blockchain ecosystem into a more integrated part of the physical world, bridging the gap between digital assets and tangible infrastructure.

Blockchain is getting more of a foothold in our daily lives even if we typically don’t realize it on a day to day basis. With it comes a great deal of investment opportunities whether related to blockain, AI or even more mainstream technology. Staying ahead of the knowledge curve will be key to exploiting investment opportunities. For me, I’m doing all I can to learn, invest and be ready. What is your plan?

Thanks for reading!

Until next time,

Macro Ark

Note that I am not a certified financial professional and am in no way qualified to offer investment advice. This article is for information and entertainment purposes only.

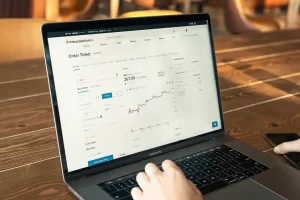

Breaking Records: Bitcoin’s Latest Price Surge Explained

December 6, 2024

If you follow cryptocurrency, and if you’re reading this article you most likely do, then you’ve been waiting for the next crypto currency bull run. It certainly appears that with the election of President Trump on November 5 that the time has come. What happens next?

Well 2024 was supposed to be the year of the Bitcoin boom. We rang in the new year with the highest of expectations. Between the halving in April and the launching of the Bitcoin ETF, didn’t we all think this was the year of the next big run? And to a large degree Bitcoin didn’t disappoint. After all, from January 1, to Halloween, bitcoin was up 59%.

Who wouldn’t call that a win? Yet for some reason, most bitcoiners- myself included – expected more. Wasn’t this the year Bitcoin was going to the moon? Or at least leave the stratosphere?

Any investor would have been ecstatic with a 59% gain for the year but it seems that we just took it in stride. And then November 5th came along. With the election of Donald Trump to a second term, the cryptoverse has now taken off like a rocket.

As I wright this, Bitcoin is at $95,216, representing another 28% gain since the day after Trump was elected. So is this the moon shot we’ve all been waiting for? It certainly seems to be. So the obvious question is, what happened?

Well if you follow crypto at all you know that over the last year you’ve heard about Donald Trump’s commitment to crypto currencies. Although in years past he publicly stated that crypto currencies such as Bitcoin were “not real money” and “highly volatile and based on thin air”.

He was firmly committed to the US dollar and seemingly had no interest in crypto currencies. Fast forward a few years and he is making another bid for a second term as president of the United States. During that time he either must have had a crypto epiphany and saw value in it or he did a great job of pandering to the crypto adherents.

It seems as though Trump was able to figure out that the believers in crypto currencies were statistically more likely to lean toward the libertarian/conservative side and possibly sought to exploit that fact.

Regardless of what his mindset was, he definitely said the right things and even got himself invited to the 2024 bitcoin conference in Nashville.

Now with his impending inauguration in January, it seems inevitable that the crypto market didn’t want to wait to start moving higher. So was a Trump victory the only match needed to get the next crypto bull run going? No, but it certainly didn’t hurt.

As mentioned above, the bitcoin ETF and halving likely were the kindling needed. With the uncertainty of what kinds of regulation the crypto world might face, the market needed assurances that the next president would be one who understood crypto currencies and much more supportive than the current administration.

Among other things, we also recently learned that SEC head Gary Gensler will step down in January. Likely he was trying to avoid any controversy with Trump, regardless of whether the president can or can’t fire the head of the SEC. Gensler was not exactly crypto friendly and from the outside it certainly appeared that he was doing his best to keep crypto currencies from becoming mainstream investment options.

So where to now? If Trump does really turn out to be crypto friendly, then the sky appears to be the limit for new coins and tokens to go to the moon. Bitcoin will lead the way and pull up the alt coins with it. Will Bitcoin hit $100,000 this year? Well it was so close at $99,000 before the whales started selling that it almost seems inevitable at this point with just over a month left in 2024.

Institutional money is accumulating and Trump has even said the that he wants to start a strategic bitcoin reserve. He also said at the Bitcoin convention in Nashville that he wanted Bitcoin to be mined in the US. (more so than currently mined)

There is no doubt then that after he was elected these pre-election promises were part of the immediate rise in crypto currencies. Will he truly be a crypto friendly president? Time will tell but I believe he will. Bitcoin has long since proven itself as a viable investment option and when the price volatility settles down it could become a currency.

If (when) this happens, the US government having a significant strategic reserve of bitcoin will certainly pay huge dividends for investors and the US government. The scarcity of bitcoin can only add to it’s price rise over the coming decades. Wall Street appears to be all in with bitcoin and continues to accumulate coins.

With the capped total number of bitcoin at 21 million coins, the planned scarcity will only add to the increase in price. That doesn’t mean it won’t have another major correction in the near future but the genie is out of the bottle at this point unless there is a concerted attempt by squash it and or make ownership illegal.

Some analysts are calling for a price per coin of $1 million per coin and I’ve heard estimates of up to $10 million per coin. I look forward to writing future posts about bitcoin’s journey. Hopefully there is nothing but good news ahead and I can one day write about how bitcoin was such a bargain at $95,000.

Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualified to offer financial advice. This article is for entertainment and informational purposes only.

The Digital Revolution: Reshaping Work, Wages, and Workforce Dynamics

November 14, 2024

What is digitization and why does it matter?

Gartner.com defines digitization as “The process of changing from analog to digital form, also known as digital enablement. Said another way, digitization takes an analog process and changes it to a digital form without any different-in-kind changes to the process itself.”

Ever since mankind evolved from early hominids hundreds of thousands of years ago to homo sapiens, technological advancements have had a profound and ever evolving impact on human labor. While innovation has driven economic growth and created new job opportunities over the centuries, it also disrupts existing roles, requiring workers to adapt to changing demands.

For the most part, technological innovations have helped move society forward and made nations and people wealthy. There are too many throughout history to discuss them all but maybe I’ll go into some of the major technological advancements in a later post. This article will provide a high level overview of how technology in the digital age will impact the workforce.

Technological change sometimes sneaks up on us slowly. For instance the internet was invented in the early 70’s and was used only by universities and some government agencies. Fast forward a few decades to the early nineties and talk of the “world wide web” is starting to happen in more mainstream circles.

Then each year more and more people start using it. First likely at work, then at home as home computers become popular. At the time it was the natural progression of a new technology but who would have known at the time the impact the internet would have on our daily lives.

Early consumer use of the internet was basically for information and then slowly for buying products. Then add in daily tasks like email, renewing your drivers license, buying airline tickets, making appointments etc. and you can easily see how all these activities have impacted not only the consumer but the people whose businesses were put online as well as those whose jobs were displaced.

Fast forward another decade or so and suddenly we have the internet on our phones. Technology increases exponentially and now we are on the verge of the AI revolution. At least for this revolution, it seems like we can see it coming. And as technology moves ever faster we are seeing just about everything moving online and thus being “digitized”.

Below are some of the primary ways that technology shapes labor markets:

Automation and Job Displacement:

Automation in Routine Tasks: Many routine and manual jobs in industries like manufacturing, transportation, and retail are being automated, which can lead to job displacement. Robots, AI, and machine learning can perform repetitive tasks more efficiently than humans, reducing the need for human labor in certain areas. The reduction in labor also leads to a reduction in workplace compensation claim and other labor related matters.

Impact on Low-Skill Jobs: Lower-skill and lower-wage jobs are more susceptible to automation, potentially leading to higher unemployment rates among these workers. This raises concerns about wage stagnation and economic inequality, as displaced workers may face difficulties in securing new positions.

Creation of New Job Roles

Growth of Tech-Related Roles: While automation replaces certain jobs, it also creates demand for new roles in technology development, AI, data science, cybersecurity, and robotics. These high-skill positions generally require specialized education and training, offering growth opportunities for workers with these skill sets.

Emerging Sectors: Advancements in technology have fostered entirely new sectors, such as e-commerce, green energy, biotechnology and AI. These industries open up new job markets, albeit with the need for specialized expertise.

Changing Nature of Work

Increased Demand for Digital Skills: As technology becomes more embedded in all sectors, demand grows for digital skills across various levels of work. Jobs that previously required minimal technological proficiency now often require at least a basic understanding of computers, data management, and digital tools. Companies are increasingly “digitizing” their processes whereby the old ways of using paper and keeping hard copies is being replaced with everything either online, in the cloud or on company servers.

Shift to Remote and Gig Work: Technology has enabled remote work and the rise of the gig economy. Platforms like Uber, Upwork, and others allow flexible, freelance work arrangements, which offer autonomy but may lack job security, benefits, and labor protections associated with traditional employment. You hear a lot more nowadays about “side hustles”. The rise in side hustles is directly attributed to the ease with which people can make additional money thanks in large part to technology.

Reskilling and Upskilling Needs

Lifelong Learning: Workers need continuous learning to keep pace with technological advancements. Many companies and governments are investing in reskilling and upskilling programs to help workers transition to new roles as their previous jobs become obsolete.

Role of Employers and Policy Makers: Employers increasingly offer in-house training, while policymakers advocate for publicly funded training initiatives. The goal is to create a resilient workforce capable of adapting to rapid technological changes. Ideally for every job lost due to technology, one or more jobs would be created. The key here is for workers to stay ahead of the digital revolution. This sounds easy but attaining new skills isn’t always easy even if you knew how to do so. In most cases, corporations will find themselves in the position of having to train their employees.

Economic Inequality and the Digital Divide

Widening Wage Gap: High-skilled workers in tech and knowledge-intensive roles are seeing wage growth, while low-skilled workers in jobs that can be automated face stagnant wages or job loss. This contributes to a widening wage gap and economic inequality.

Access Disparities: The digital divide — unequal access to technology and digital skills — limits opportunities for certain demographics, often along socioeconomic, regional, and generational lines. Addressing this divide is crucial to ensure equal access to new labor opportunities created by technology. A growing gap between the haves and the have nots will ultimately lead to civil unrest or worse.

Productivity and Economic Growth

Increased Productivity: Technology boosts productivity, allowing companies to achieve more with fewer resources. This can lead to economic growth, lower production costs, and potentially lower consumer prices.

Shifting Value Chains: Globalization, facilitated by technology, shifts production and service tasks to regions where labor is more affordable or skilled in particular domains, affecting job availability and wages in different parts of the world.

Policy and Ethical Considerations

Regulation of AI and Automation: Policymakers grapple with regulating AI and automation to prevent excessive job loss and ensure fair labor practices. They also work to balance technological innovation with workers’ rights.

Universal Basic Income (UBI) and Social Safety Nets: Some policymakers are exploring UBI or other safety nets to support workers who may face prolonged displacement due to rapid technological shifts.

Now add in blockchain and technology really gets super charged. Investopedia defines blockchain as follows: “Blockchain is a decentralized digital ledger that securely stores records across a network of computers in a way that is transparent, immutable, and resistant to tampering. Each “block” contains data, and blocks are linked in a chronological “chain.””

So what is meant by “securely stores records”? Well once something is on the blockchain, it is there for good. Things such as contracts, licenses, titles to cars, mortgages and just about any other document we all use in our day to day lives will soon be part of the blockchain. Once on the blockchain it will be “immutable” or unable to be changed. This will allow for documents to live forever without the possibility of being lost, stolen or altered. This will inevitably lead to many industries if not going away, certainly needing fewer workers.

With the addition of AI (artificial intelligence), things are going to be supercharged. AI will displace workers in just about all fields. In particular jobs that are easily repeatable and considered low skilled.

That said, between blockchain and AI, is there a need for lawyers? Or bankers? Or mortgage brokers? Or underwriters? Unless your job has a unique value proposition that cannot be replaced and requires a human element to it, you are likely at risk of succumbing to the next revolution.

So what to do? What steps do you need to take to ensure your job doesn’t get digitized, put on the blockchain or AI’d away? Learn. Learn as much as you can about this new wave of technology and do whatever possible to stay a step ahead. Once you learn how these technologies work and can be utilized, you can identify both threats and opportunities to not only your job but to you investments as well. As the homepage of my website states….”The Future Belongs To Those Who Are Prepared”. Will you be?

In Summary:

Technological advancements in the labor market present a dual narrative of opportunity and disruption. The challenge lies in balancing the benefits of innovation with the potential negative impacts on the workforce. Efforts in reskilling, policy adaptation, and economic redistribution will be critical in ensuring that technological progress translates into shared prosperity rather than increasing inequality. The digital genie was let out of the bottle decades ago. With just about every aspect of our lives becoming digitized. and the ever increasing pace of technological change, there is too much at stake to not be ready for it.

Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualified to offer financial advice. This article is for information and entertainment purposes only.

The Everything Bubble: Navigating Uncertain Economic Waters

November 1, 2024

OK, so here we are. On the eve of a presidential election, riding all time highs in the stock market, gold hovering around all time highs, residential real estate still in bubble territory in many markets. Everything is great right?

Well from certain perspectives it certainly is. The stock market refuses to acknowledge gravity and continues it multi year expansion. Although real estate is certainly seeing some signs of weakening in the more bubble like markets, it is essentially still holding up pretty well. And inflation is for the most part under control in that it’s been reduced to 2.4% for the twelve months ending in September. Everything is great right? What’s not to be euphoric about?

Interest rates were slashed 50 basis points (0.5%). The rate cut was certainly not unexpected as people have been waiting for it essentially since the beginning of the year.

What was surprising was the amount the fed rate was cut. I don’t think anyone was expecting a 50 basis point cut. This then begs the question of why? Why did Jerome Powell see a need to to cut that much? Does he know something that the rest of us don’t? It would appear that he realized that the economy was not all roses.

So what would prompt a never done before 50 basis point rate cut? It looks as though Powell perhaps sees the economy on the brink of something bad and is trying to hit the brakes before something bad actually happens.

After all, haven’t we kind of been living on borrowed time since the great financial crisis? Once the Quantitative Easing (i.e. money printing) began so many years ago, the genie of bad monetary policy was let out of the bottle — possibly for good. It began the slow but steady process of inflating the stock market and increasing the wealth inequality gap.

Coupled with artificially and unrealistically low interest rates, the housing market has now found itself in many markets in a mania phase. How about all of those people who thought they could get rich with AirBnB rentals?Fast forward 15 or so years and here we are — caught up in a merry-go-round that keeps going faster and faster with no good way to get off.

With the everything bubble upon us, wars around the globe which seem like they could get out of control at any moment, Powell was likely trying to get ahead of the pin that pricks the bubble.With the long term debt cycle coming to an end and the BRICS nations recently meeting in Russia for a BRICS summit, the long term outlook for the US and global economy doesn’t look good. The list of possible pins to prick the everything bubble is long. Let’s take a look:

US Presidential election impact: This is a complete wildcard. Whichever side loses won’t be happy and negative blowback from either side could have economic consequences.

Stock market performance: If this bubble bursts, it will likely take down the others with it.

Real estate market: Holding strong in many markets but definitely showing signs of weakness.

Inflation: Seemingly under control but a re-flash of high inflation could be devastating to the economy.

Interest rates: Likely won’t be raised again soon in light of the recent cut but should inflation spike, count on interest rates going up and threatening the economy.

Wars in Ukraine and the Middle East: Either one or both could spin out of control and wreak havoc on the global economy.

With that I would say that the US economy is resilient and I’ve heard from more than one podcast guest that they don’t see any sign of a recession in the next 6 months.So what to do now? Regardless of your level of optimism or pessimism, you must keep a watchful eye on all of the aspects of macroeconomics. Knowledge is king in uncertain times — especially when there is so much on the line and so much that could just wreck the economy and your finances as well.

Stay up to date with podcasts and news sites where you can learn as much as possible about what might be coming so as to make the best possible decisions for your financial future.

One point of note here is that gold prices are hovering around historic highs, potentially indicating economic uncertainty. Central banks in countries around the world have been stock piling gold in recent years and gold seems to be getting more attention in the US.

Typically, people flock to gold in uncertain times as gold is an inflation hedge. Maybe the people who follow macro economics closely know something………

Thanks for reading!

Until Next Time,

Macro Ark

Note that I am not a certified financial planner and am in no way qualified to offer financial advice. This article is for information and entertainment purposes only.

The Best Cryptocurrency Tools for Beginners and Pros Alike

October 2024, 2024

The cryptocurrency world has certainly turned around in 2024. It will likely still be a rollercoaster ride for the foreseeable future. Are you ready to test the water or are you already in? Regardless, read on………

So you think you want to get into Bitcoin and / or other cryptocurrencies? Well if so, there are some things you must learn about the crypto world that you’ll need to do. Not only to do research on different coins and tokens but also how understand how to buy and store them. Before I go into any detail, I’ll start by making my typical signoff of my posts. And that is…….I am not a certified financial professional and am in no way qualified to offer financial advice.

That said, I have been studying cryptocurrencies for the last 5 years and have learned enough along the way to know to know there are certain things that anyone involved in cryptocurrencies should know about.

Step number one is to learn as much as possible prior to buying any coins or tokens. I started by learning about blockchain and bitcoin by taking multiple classes on Udemy.com. Udemy is an easy way to learn pretty much any topic on line. I wanted to understand what bitcoin the coin (lower case b) was as well as Bitcoin the blockchain (upper case B). Udemy is essentially a version of Youtube where you pay for classes. It was well worth it for me as some of the courses do have downloadable material. The courses I took gave me a great foundation for understanding how the Bitcoin blockchain works.

Next up is Youube. Youtube is great since it is free and there is also almost unlimited content. Pick something about Bitcoin, blockchain, wallets etc. and someone on youtube is more than happy to tell you about it.

The other aspect of learning has to do with the coins and tokens themselves. I listen to multitude of podcasts to get insights from those heavily invested in the crypto-verse and over 5 years have gained quite a bit of knowledge on what individual projects do and how they can provide value to society.

I also subscribe to a variety of content specific to crypto such as “Alt Coin Daily”, “Coin Bureau” and “Benjamin Cowen” to name a few. Consistently watching these videos can give you virtually unlimited knowledge of crypto if you are willing to invest the time. I set a goal of watching two per day. With a 45 minute commute to work and time in the gym, I have plenty of time to watch 2 videos.

A point I want to make here is that the blockchain genie is out of the bottle as I mentioned in one of my previous posts. The technology associated with blockchain is far too beneficial to be disregarded as a fad. Think internet at this point…….. times maybe 1,000 (strictly hyperbole!).

Then understand the benefits that blockchain can provide:

- Cost Efficiency

- Speed

- Enhanced Traceability

- Smart Contracts

- Gaming/Entertainment

- Data Integrity and Ownership

- Tokenization of Assets

Knowing the benefits of blockchain will help you understand the value proposition of the different projects and thus aid with any investment decisions. As mentioned above, there is certainly no shortage of information available on the web to provide as much information as one might be looking for for any particular project.

Next up — how to buy cryptocurrency. By now, if you have any interest in cryptocurrency you’ve heard of the term “exchange”. But just in case you haven’t, an exchange is where you go to buy cryptocurrency. I would guess the most familiar exchange — at least in the US — is Coinbase. Binance could be a close second and likely one of the more popular exchanges globally.

Working with an exchange might seem intimidating at first but ultimately, once you are set up it is essentially like working with your bank. To get started, you have to first go through the administrative process of identifying who you are which can be bit disconcerning as you have to provide the exchange a good deal of your private information and in some case, even your picture.

When I first began getting involved with crypto, this was admittedly almost a non-starter for me. I didn’t like the idea of surrendering my data to an exchange that, at the time, I didn’t necessarily have a lot of trust in. Eventually, I just swallowed my concern and did it. I chalked it up to the new world I was entering and had faith that the exchanges I was getting involved with were legitimate. The next step was to set up your bank with the exchange. This was fairly simple and basically the same as setting up your bank for any payment method.

Now comes the easy part. Buying crypto. Presumably by now you’ve done some cursory amount of research on the projects you want to invest in and presumably a great deal of research.

Find the token or coin you are looking for, type in how much you want to invest and hit the buy button. Done. But not really. Well, you’re done in that you’ve officially bought cryptocurrency. But now comes the part that many people ignore. That would be taken actual possession of the coins or tokens.